25 / Jan

In the lead up to the ban of TikTok in the US, long time users of the platform rushed to other platforms as #tiktokrefugees to connect with their existing followers or restart their social media presence from scratch.

In a surprising twist, many went directly to another Chinese social media platform, Xiaohongshu, now known as RedNote in the US. Around 3 million new user accounts were started on the platform in just over a week, representing around 2% of the USA TikTok user base.

RedNote quickly climbed to the top of Apple’s US App Store, and the influx of new user marked the platform’s first large-scale entry into the Western market, especially with the wide reporting by outlets including Reuters, BBC, CNN and The Washington Post.

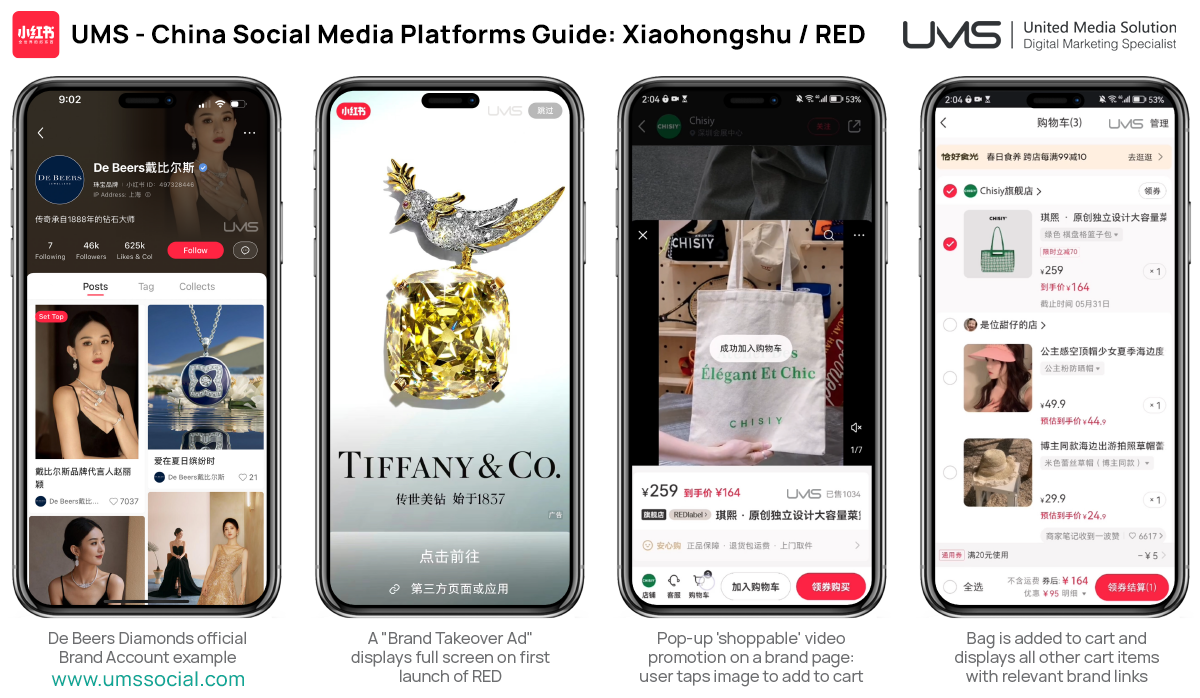

As the confusion over TikTok USA’s fate continues, (as 75 day extensions continue to be granted), there is an opportunity for brands to engage with active content creators that are establishing themselves on other platforms, including Xiaohongshu. A platform that combines some of the best social media and ecommerce features of TikTok and Instagram.

What is RedNote / Xiaohongshu / Little Red Book?

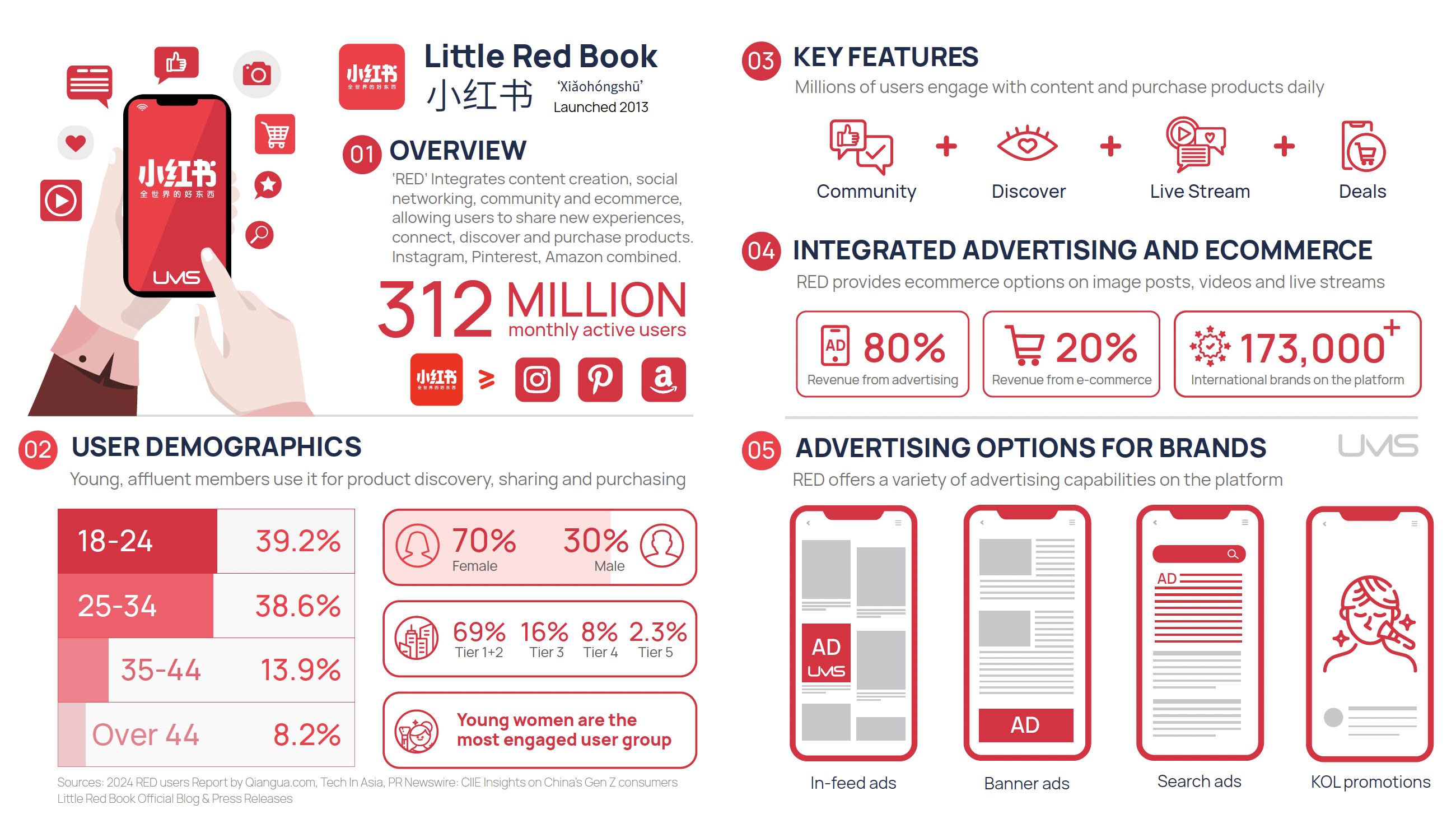

Red is a well-established Chinese social media app, launched in 2013, and how has over 300 million monthly active users with around 5-8% of those users outside of mainland China. The platform’s core focus on lifestyle content—covering travel, food, beauty, fashion, and wellness.

The core demographic of Red users are highly educated, living in 1st and 2nd Tier Cities in China, with strong spending power. The audience is 70% female and his continues to boost the popularity of categories including fashion, cosmetics and beauty.

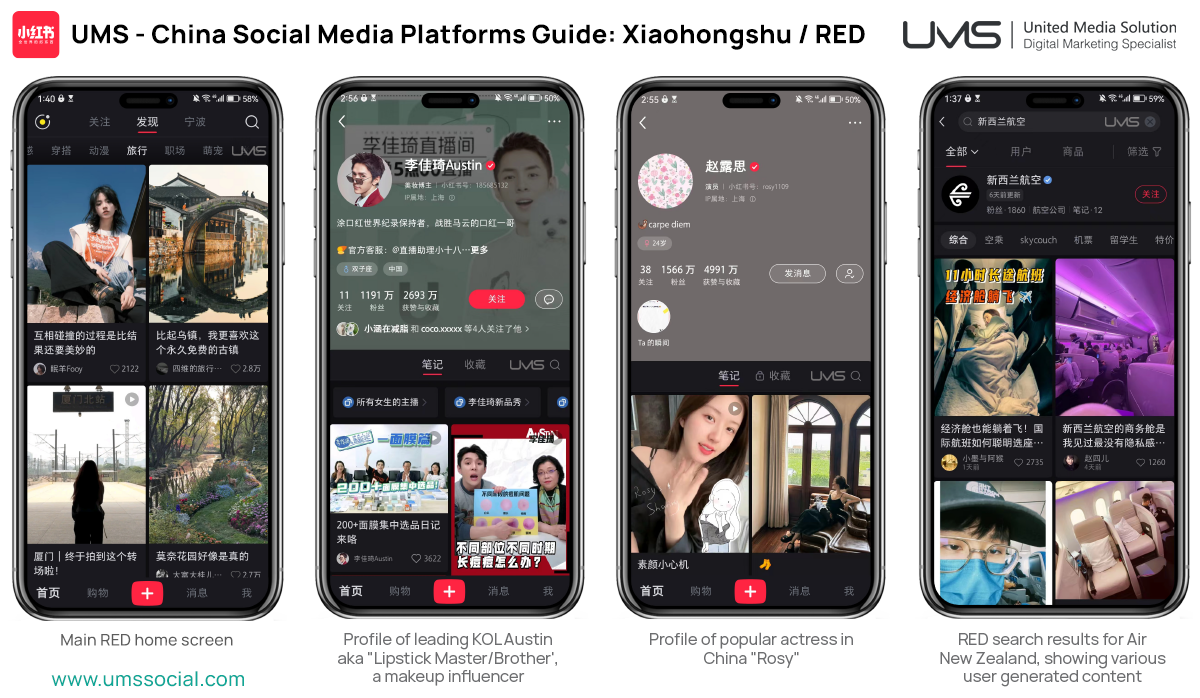

It is most often compared to TikTok for its short-form video capabilities and Instagram for its visual curation, along with the “cluster feed” of Pinterest where 4 items can be seen at once on the feed, rather than a single item at a time on Instagram.

Like TikTok and Douyin, Red has also become a go-to search engine for user-driven recommendations, such as travel tips and product reviews. This is due to the “Nearby” tab on the home page, which only shows content that is close to the user, which boosts local engagement and social sharing.

Americans that joined the platform are largely seeing content from other Americans in the US, alongside content from Chinese speaking Americans. There has been plenty of curiosity about the platform and many new users are enjoying being able to connect and share content in a similar way to their experience on TikTok.

Search & The Social Commerce Cycle

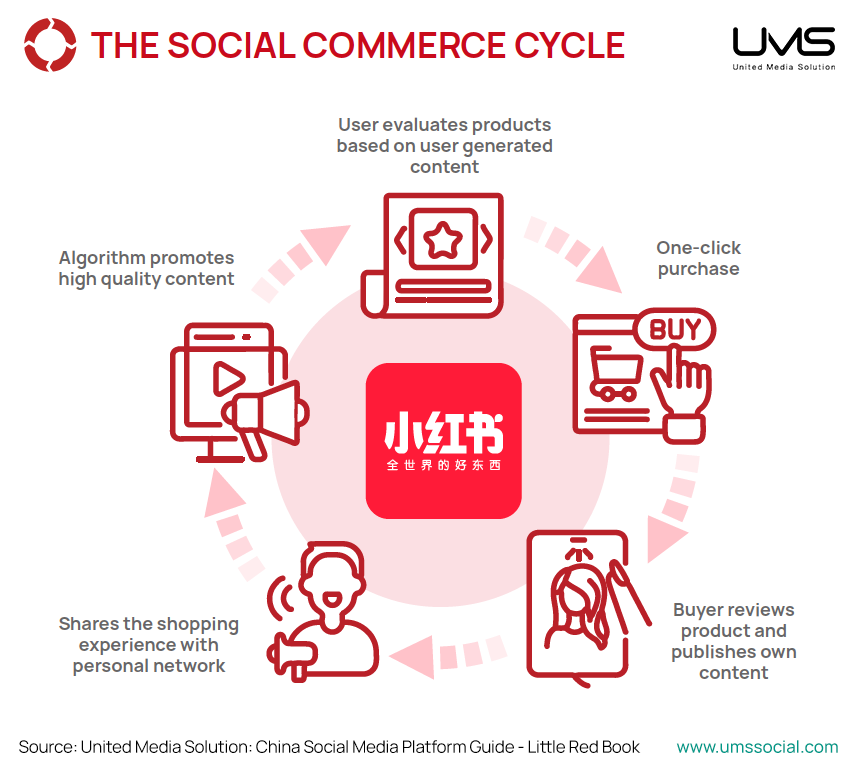

The use of Red as a search engine for product reviews creates a positive feedback loop known as the ‘social commerce cycle’. Users check product reviews, and then buy products directly inside the app, from brands or creator “shops” (Similar to TikTok Shop and Instagram Stores). Users then post their own reviews of the product on the same platform they purchased from, and the cycle continues.

Instagram has shoppable posts, but that platform is not used as much for product reviews or as a search engine for reviews, so Red has a significant advantage here for engaging with an audience that is actively looking to buy products which are related to the most popular content areas.

Red has a dynamic and organic way to build communities, including live streaming and excellent hashtag and trend integration, similar to the organic engagement that has make TikTok so popular. Content does not always need to be polished and perfect, can be casual and more authentic.

What’s Next for Users and Brands?

For many TikTok Creators that have generated large audiences, including those that earn income in the USA from live streaming or TikTok shop sales, the potential ban and the uncertainty around it has been particularly frustrating. Many have seen the ban as a level of overreach into their personal and professional use of social media in the USA.

The new arrivals to “RedNote” have been welcomed to the platform with a mixture of confusion and surprise, with many discussions of everyday life, comparisons to annual salary and weekly grocery bills being shared. Duolingo also noted a significant rise in downloads and signups for learning Mandarin.

For brand owners, this surge in adoption represents a golden opportunity to tap into a new and rapidly growing user base. The platform’s focus on community-driven discovery means advertisers can benefit from Red’s high engagement and potential to build brand loyalty among culturally curious audiences.

Despite its popularity, RedNote is still adapting to Western markets. The app’s interface and icon remain largely tailored to its Chinese roots, with minimal bilingual support. While this may present a hurdle for some users and advertisers, it also highlights RedNote’s significant growth potential.

The development teams are working to make the platform more user friendly to English-speaking audiences. On international app stores, the app icon is still in Chinese and has not yet switched over to an English logo.

Some brands are already playing up the TikTok ban and becoming #tiktokrefugees themselves, and posting on Red and other platforms, including Lemon8. The setup of official accounts on platforms in China takes longer than on Western ones, and there will be a range of popular brands on TikTok in the US that are keen to follow their audience of existing and potential customers to other platforms.

For now, Red’s rapid rise may be part of a wider fragmentation of the social media landscape, as users look to other platforms to share and consume content on. For brands already advertising on TikTok, transitioning to or incorporating Red could ensure continued access to a young, engaged audience and a way to remain relevant and competitive.

Make sure to follow some of our clients on Xiaohongshu:

For more insights on Red, make sure to download our China Social Media Platforms Guide here:

https://www.umssocial.com/china-social-media-platform-report/download

Comments (0)